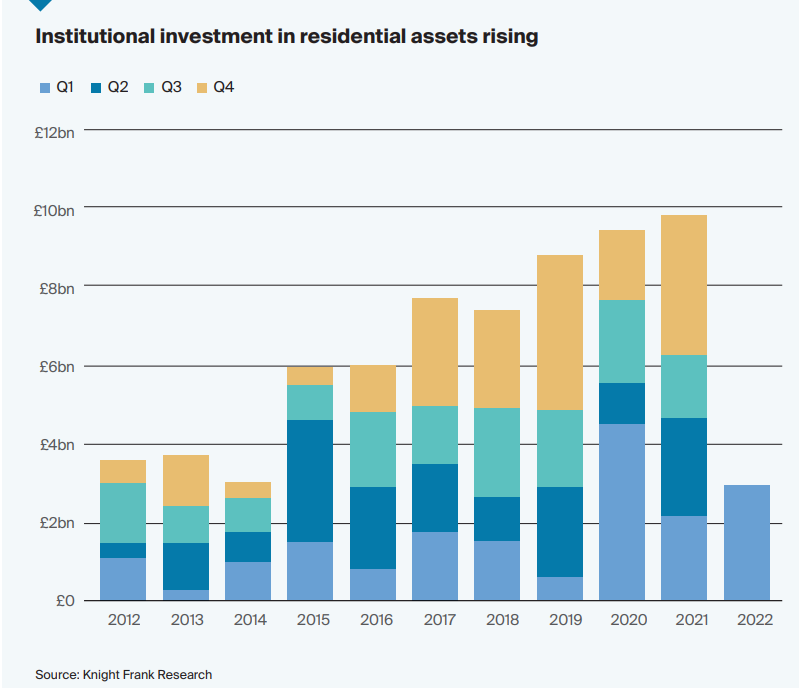

As per Knight Frank research, Institutional investment into residential assets, encompassing student housing, co-living, multifamily, single-family rental and seniors housing, accounted for 15% of all institutional UK real estate spend in 2021 and 22% in 2020, valued at approx £9 bilion and £9.5 bilion respectively only behind offices and a resurgent logistics sector. Ten years ago, residential accounted for just 8% of all acquisition activity. Figures for Q1 2022 suggest that investor demand remains strong. Institutions have committed a further £2.9 billion in the first three months of the year, which is higher than the level achieved during the same period last year and in line with the quickening pace of investment activity over the past 12 months.

Demand is driven by a combination of strong structurally supportive market dynamics, an evolving service-focussed product, as well as an expanding and more discerning occupier base. There is little doubt, as well, that Covid-19 has transformed the way global institutional investors look at real estate. The residential investment sector has proven resilient by delivering secure income in uncertain economic conditions. As well as existing investors looking to build scale, activity is being fuelled by a deepening pool of capital looking to target residential.

Some 23% of institutional investment in the Built-to-Rent (BTR) market last year was from new entrants to the UK market, for example, while for seniors that figure was 48%. For student, even as the most mature market, 22% of deals last year went to new capital. As per Knoight Frank it is expected to see to ‘significantly increase’ in investment in residential assets over the next five years

Source: Knight Frank Residential Investment Report 2022